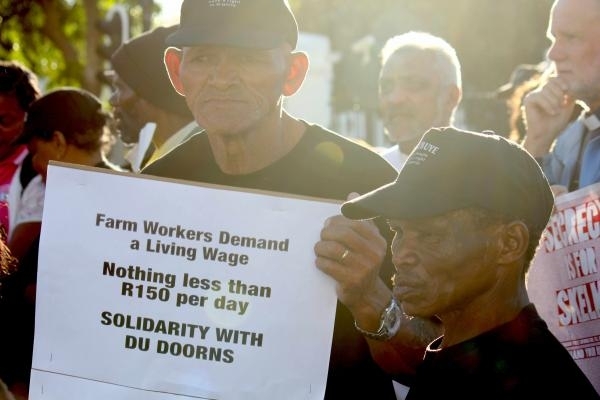

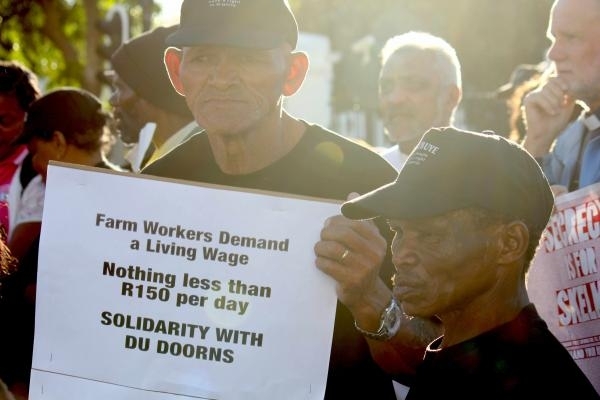

Whether higher minimum wages destroy jobs depends on the level of the wage and conditions in the sector. Photo by Kate Stegeman.

25 November 2015

Deputy President Cyril Ramaphosa is hosting a social dialogue between business, labour and other constituencies over setting a national minimum wage (NMW). This is the second of a three part series by two University of Cape Town professors. Part one looked at South African minimum wage-setting in comparative context. Here they discuss the relationship between minimum wages and employment.

The International Labour Organisation suggests various benchmarks for minimum wage setting but always recommends that countries take local factors into account when finding an appropriate balance between social and economic considerations. South Africa’s extraordinarily high rate of unemployment and weak capacity to generate new jobs out of economic growth are the key country-specific economic factors that need considering when setting minimum wages.

South Africa is among a small group of mostly Southern African, post-communist and war-torn countries that have high unemployment rates and low employment rates (percentage of adults aged 15 and above who are employed). A low employment rate implies the country is not fully using its available human potential. A high unemployment rate implies that many of the jobless are frustrated work-seekers. For this small group of countries, job creation is clearly an urgent economic and social priority.

Some countries can grow themselves out of this corner – but this is not true of South Africa. Not only does South Africa have a below-average employment rate and an above-average unemployment rate, it also has a very poor track-record in generating new jobs through growth. It is thus very important for South Africa’s growth path to become more ‘labour-intensive’, to generate more jobs through growth, especially for poor unskilled people. The poorest 20% of households rely predominantly on grants and remittances for their survival. Increasing the number of jobs, even at low wages, will help reduce poverty, whereas destroying available low-paying jobs for unskilled people runs the risk of tipping many poor households into even deeper poverty. This has important implications for minimum wage setting.

Higher minimum wages encourage firms to shed lower skilled labour in order to improve productivity and protect profits. Some firms might be able to improve efficiency in other ways (perhaps re-organising production without firing anyone) and some firms might benefit from the fact that higher paid workers have more to spend on their products. The impact of higher minimum wages thus depends on the level of the new minimum wage and the position of affected firms in the broader economy. Those facing international competition (in the ‘tradeable’ sectors’) are the most likely to shed labour because they are already under pressure to be as efficient as possible given the existing labour force.

Precisely because the level of the minimum wage increase and the location of affected firms in the economy matter for the effect on employment, it is unsurprising that the international literature reports a wide range of findings about the effect of minimum wage increases on jobs. The available studies show that the effect is typically mildly negative (mostly for relatively unskilled workers) or neutral, and sometimes positive (e.g. Freeman 2009, Betcherman, 2014, ILO, 2015: 59).

For advocates of minimum wages, this somehow ‘proves’ that concerns about job losses following the imposition of a minimum wage are misplaced. But as Freeman observes: ‘The evidence that employment responses are often negligible does not mean that demand curves do not slope downwards nor that a higher minimum wage cannot decimate employment. Rather, it suggests that governments set minimum wages with due consideration to the risk that minima can cause more harm than good’ (2009: 13).

Such an assessment is consistent with evidence showing that larger employment losses are associated with larger minimum wage increases and that the primary losers are lower-skilled workers at and below the level that the minimum wage ‘bites’ (Betcherman, 2014: 8).

The ILO (2013) found that minimum wages have had small or no effects on employment in developed countries, but concludes that employment effects in developing countries depend on the economic context, the level of the minimum wage, enforcement, and the ‘labour market peculiarities and institutions prevailing in each country’ (2013: 49).

In South Africa, the Employment Conditions Commission (ECC) is currently required to take into account the possibility of job losses when setting minimum wages. This explains why it sets different minima in different sectors. The Basic Conditions of Employment Act (BCEA) allows the Minister of Labour to ask the ECC to recommend a minimum wage covering all workers who are not covered by existing sectoral determinations or by collective agreements negotiated by trade unions and employers under the Labour Relations Act. The BCEA thus already allows for a natinal minimum wage to be set, taking into account likely employment effects. The ECC would thus be the appropriate body for considering what level a national minimum wage should be set.

As in the international literature, South African studies of the impact of minimum wages on employment found mostly modest effects on employment when set at low levels. Job destruction has however, occurred when minima were raised dramatically, especially among less skilled workers in ‘tradeable sectors’ ( those sectors exposed to international competition).

Workers in non-tradeable sectors, notably domestic work and retail, face very different wage employment elasticities than those in traded sectors. Hertz (2005) found that the introduction of a minimum wage (in 2002) caused a drop in hours worked but that the increase in pay more than compensated domestic workers and their wage income increased. Subsequent estimates found no impact on hours (Dinkelman and Ranchod, 2012) and a negligible negative impact (Bhorat et al, 2012). This suggests that the ECC broadly got the level ‘right’. However, it is worth noting that there may be substantial non-compliance (reported levels of 39%) with regard to the payment of minimum wages to domestic workers, so it is likely that ineffective regulation also helped protect against job losses.

The situation for workers in traded sectors is very different - agriculture being the most notable example. Bhorat et al. (2014) show that the introduction of a minimum wage in 2002 accounted for most (200,000) of the subsequent job losses. It is too early to say how many jobs were lost following the huge increase in the minimum wage in agriculture in 2013, but anecdotal evidence suggests that job destruction was again considerable even over the short-term, affecting especially women. In the (tradeable) forestry sector, Bhorat et al. (2012b) found that the sectoral determination did not lead to any observed improvement in total earnings, because higher wages were offset by a reduction in working hours. Non-compliance (53%) was also high in this sector, likely providing some cushioning against job losses.

The clothing sector is also a traded sector, and since the creation of a national bargaining council in 2003, minimum wages have been set nationally through collective agreements. Employers and workers have kept real wage increases modest except in low-wage non-metro areas where minimum wages rose faster. This has undermined the most labour-intensive end of South Africa’s last remaining labour-intensive manufacturing sector (Nattrass and Seekings, 2014). If it had not been for continued non-compliance with these wages by many low-wage firms, job losses would have been even worse.

There is thus plenty of evidence that the labour demand curve in South Africa slopes downwards, meaning that higher wages typically translate into fewer hours worked and even job losses. This raises the issue of the impact of a national minimum wage on employment. According to the National Treasury, a national minimum wage of R1,886 would affect 45% of unskilled workers and 43% of farm workers and 52% of domestic workers. Using a slightly different definition of full-time workers, Finn calculates that a wage of R3,000 would affect over 80% of agricultural and domestic workers (Table 2).

|

Where minimum wages would bite: |

|

|

National Treasury: A wage of R1,886 would affect: |

45% of primary educated labour, 43% of agricultural workers, 52% of private households |

|

Arden Finn: A wage of R3,000 would affect |

About 40% of all full-time workers, about 45% of full-time clothing workers, 82% of full-time workers in the agricultural sector, 87% of full-time workers in domestic services |

Table 2. Where the NMW ‘bites’. Source: MacLeod (2015), Finn (2015). NB: MacLeod and Finn are using different data sources and definitions.

The large number of workers affected (by either calculation) is cause for concern. Those who gain extra money and do not lose their jobs will clearly benefit. The problem, however, is that some if not many could become unemployed, plunging their households into deep poverty. The threat of job losses will vary from sector to sector and will depend on the level of compliance. Where non-compliance is high and tolerated (i.e. many firms ignore the national minimum wage and the wage is not enforced by the relevant institutions) then the impact on both incomes and employment will be lower. Even so, firms remain vulnerable to inspections and legal action, hence the business environment is risky and uncertain for them.

Non-compliant firms may keep operating, but gradually change their technologies, not replacing unskilled workers when they leave. The result over the longer term is thus likely to be a decline in labour-intensity as firms shed their unskilled labour, mechanise, or move into less labour-intensive sectors. Some, perhaps many, workers who lose their jobs might end up getting jobs elsewhere. But this depends on how the economy reacts dynamically and over the longer-term. We pick up this issue in part three.

Betcherman, Gordon (2014), ‘Labor market regulations: what do we know about their impacts in developing countries?’, World Bank Research Observer, published online, version ‘lku005’.

Bhorat, H., Kanbur, R., & Mayet, N. 2012a. The Impact of Sectoral Minimum Wage Laws on Employment, Wages and Hours of Work in South Africa. Cape Town: Development Policy Research Unit.

Bhorat, H., Kanbur, R., & Stanwix, B. 2012b. Estimating the Impact of Minimum Wages on Employment, Wages and Non-Wage Benefits: The Case of Agriculture in South Africa. Cape Town: Development Policy Research Unit.

Dinkelman, T., & Ranchold, V. 2012. Evidence on the Impact of Minimum Wage Laws in an Informal Sector: Domestic Workers in South Africa. Journal of Development Economics, 27-45.

DPRU. 2015. Exploring Minimum Wage Impacts: Global Evidence and South African Considerations. A Presentation to NEDLAC. 29 June 2015.

Finn, Arden. 2015., ‘A National Minimum Wage in the Context of the South African Labour Market’, National Minimum Wage Research Initiative Working Paper no.1 (Johannesburg: University of the Witwatersrand, August).

Freeman, R. B. 2009. Labor regulations, unions, and social protection in developing countries: market distortions or efficient institutions? (No. w14789). National Bureau of Economic Research.

Hertz, T. 2005. The Effect of Minimum Wages on the Employment and Earning of South Africa’s Domestic Service Workers. Kalamazoo: Upjohn Institute Working Paper No. 05-120.

ILO. 2013. World of Work Report 2013 (Geneva: International Labour Organisation).

ILO. 2015. Global Wage Report, 2014/5: Wages and Income Inequality, ILO Geneva. Available: http://www.ilo.org/global/research/global-reports/global-wage-report/lan…

MacLeod, Catherine. 2015. Measuring the impact of a National Minimum Wage, National Treasury, October.

NMWRI (presented by G. Isaacs). 2015. National Minimum Wage Research Initiative: Presentation of Research Programme. NEDLAC, 15 June.

Nattrass, N. and J. Seekings. 2014. Job Destruction in Newcastle: Minimum Wage Setting and Low-Wage Employment in the South African Clothing Industry’, in Transformation, 84: 1-30.

Part one: Comparing South Africa to other countries

Views expressed are not necessarily GroundUp’s.