Zimbabweans in SA feel pinch of weak rand

Zimbabweans living in South Africa are feeling the pinch of the steep fall of the rand against the US dollar. Because they are earning rands, they are able to send less money home.

In 2009 Zimbabwe adopted the dollar after the ruling ZANU PF and the main opposition MDC agreed to a “Government of National Unity.” The use of the US dollar brought currency stability and dealt with the problem of hyperinflation. But the recent fall of the rand against the dollar has meant that the wages and salaries earned by Zimbabweans in South Africa are worth less in US dollars.

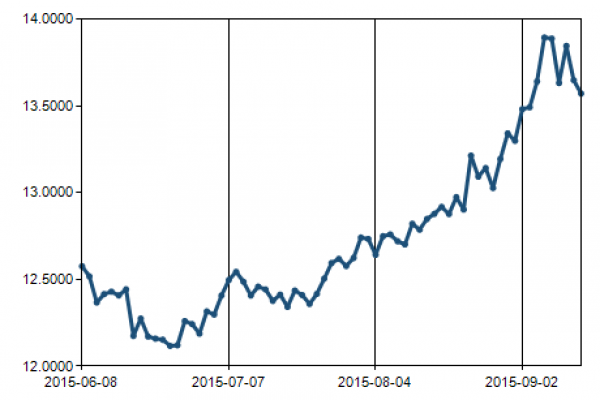

South African Reserve Bank figures show that the value of the rand has changed from 11.7979 rand to the dollar on 6 March to 13.6474 on 11 September. This means that while R1 could buy 8.5 US cents on 6 March, it could only buy 7.3 US cents on 11 September. Over the same period, say Zimbabweans, the black market rate moved from around R100 for $8 US to R100 for $7 by early September.

Financial analyst Brighton Maravanyika, 35, said most Zimbabweans living and working in South Africa had families at home in Zimbabwe and sent money back regularly. The fall in the rand against the dollar would mean they would struggle to pay children’s school fees, rentals and other costs, he said.

“Two months back when I sent US $340 back to Zimbabwe, I paid R4,700. Only three days ago, for the same amount I parted with R5,300,” said Dr Tyanai Masiya. He said he was now considering bringing his whole family to South Africa.

Unice Mutimbanyoka, 49, who has been selling doilies in South Africa since 1998, said it was now difficult to make ends meet at home. “I pay US $1,200 per semester university fees for my child [at the University of Zimbabwe], and that means I have to sweat to get about R16,000.”

She said a loaf of bread cost $1 which would now be R13.

A bus ticket from Harare to Johannesburg currently costs about $25. But bus operators on the Harare-Johannesburg route said they had not noticed a significant drop-off in passenger numbers. “We have not experienced an effect on ticket sales due to the exchange rate,” said a spokesperson for bus company Intercape.

Mukuru and Mama money, agencies which transfer money from South Africa, said they had not noticed a fall in remittances from Zimbabweans in South Africa. Zimbabweans working in South Africa find it cheaper to buy goods in South Africa using the rand, but the Zimbabwean government has set high import tariffs to protect local industries.

Support independent journalism

Donate using Payfast

Don't miss out on the latest news

We respect your privacy, and promise we won't spam you.

This article is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.