Minister wins battle with Lion

Insurance company backs down in battle over deductions from social grants

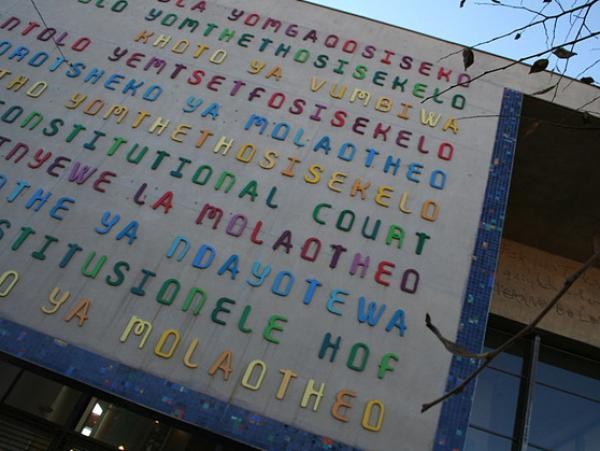

The Minister of Social Development and the South African Social Security Agency (Sassa) won a victory in the long battle against Lion of Africa Assurance in the Constitutional Court this morning over deductions from children’s grants.

The upshot of the settlement, made an order of the court, is that new direct deductions for funeral insurance from children’s grants will not be allowed. However, direct deductions that took place before 31 December 2015 can continue to be made.

Lion of Africa won an interim order allowing deductions in December last year, but was not allowed to enforce it pending an appeal by Sassa to the Constitutional Court. The appeal was to be heard today but a settlement was reached.

In the settlement, Lion of Africa agreed not to take advantage of the interim order, and the Minister and Sassa withdrew their appeal. From 6 May new regulations kick in anyway, banning new direct deductions for funeral policies from children’s grants, and giving insurers 6 months to arrange other means of payment..

Sassa is to carry the costs of the legal action.

The matter concerns nearly 12 million beneficiaries of the R350 a month child support grant, and also about 130,000 beneficiaries of the care dependency grant of R1,500 a month and more than 450,000 beneficiaries of the foster child grant of R890 a month.

The battle has raged for months. The Black Sash, admitted as a “friend of the court”, has argued among other things that the purpose of the children’s grants is to give effect to the rights of children in the Constitution, and that diverting money from children’s grants for a funeral policy – whether that of the child or another member of the family - is not in the interests of the child.

“It will seldom (if ever) be the case that a deduction for a funeral benefit is necessary and in the interest of the child beneficiary,” the Black Sash argued.

Lion of Africa, on the other hand, argued that the beneficiaries of children’s grants were not only the children but also their primary caregivers, and that the interests of the child were “intimately linked to those of his direct and extended family”.

“Lion submits that if the child’s interests are viewed in the context of the family (in the widest sense) in which s/he is raised, it is easy to see how funeral cover is in the child’s interest.”

The insurance company also argued that since funerals were “a major expense item”, and many of the policies are family policies, the pay-out from a funeral policy for the death of a child or close family member “may save the family from destitution”.

At stake for Lion of Africa is the roughly R1.7 million a month in income the company gets from premiums for funeral insurance paid by 20,000 beneficiaries of children’s grants. The premiums range from R30 to R180 a month.

In a study commissioned by the Black Sash, Roseanne da Silva, president of the Actuarial Society of South Africa, estimated on the basis of child mortality statistics that less than 1% of the premiums paid to Lion of Africa would be needed to pay out for funerals for children.

“This means that only R17,000 of the R1.7 million premium received per month would be applied to the payment of claims with the balance of R1,683,000 going towards administrative expenses and profit of Lion of Africa Assurance,” she said.

Da Silva concluded that “the policy does not offer value to the policyholders”.

In a statement today Lion of Africa said it was not opposed to the ban on deductions from child support grants but had been concerned that due process should be followed. The company said the court ruling last December had shown that Sassa was not entitled to change the law by issuing a directive. However the Minister had since clarified the matter through the new regulations issued on 6 May.

“It is important to note that Lion of Africa Life is not, and has never been, opposed to the prevention of deductions from child support grants. The company was concerned for the legal process and challenged the right for any entity to change the law without following due process. At the time Lion of Africa Life fully complied with the directive and the company will continue to operate within both the spirit and the letter of the law in all respects,” the company said.

Sassa has also been locked in battle with another insurance company, Sanlam’s Channel Life unit, over what constitutes written consent by a grant beneficiary for the deduction of premiums for funeral insurance. This follows the “clean-up process” set up by Sassa to stop unauthorised and illegal deductions from all social grants, for airtime, water, electricity and other services. On 10 May the North Gauteng High Court ruled that if Sassa intended to stop a Channel Life funeral policy deduction in terms of the “clean-up” process, the insurer would have to be notified.

This article was updated to take into account the court settlement and comments from Lion of Africa.

Support independent journalism

Donate using Payfast

Don't miss out on the latest news

We respect your privacy, and promise we won't spam you.

Next: Uber and out: Drivers in Cape Town are working 24-hour shifts for low pay

Previous: No mining in Xolobeni, demand activists

© 2016 GroundUp.

This article is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.

You may republish this article, so long as you credit the authors and GroundUp, and do not change the text. Please include a link back to the original article.